MARKET OVERVIEW

Chris Stanton-Jones

Catapult Business Solutions

Culturally, gaming is a new phenomenon for the Indian market. Although it has been present in India since the early days, games have traditionally been quite niche with PC the largest format. It has also been dominated by high piracy and a very under-developed retail environment, while the main import channel was previously an uncontrolled grey one.

Furthermore, it has been quite difficult for games to emerge from the overpowering dominance that Bollywood holds over entertainment in the home and getting acceptability from the parents has and will continue to be one of the key challenges to making the market mainstream.

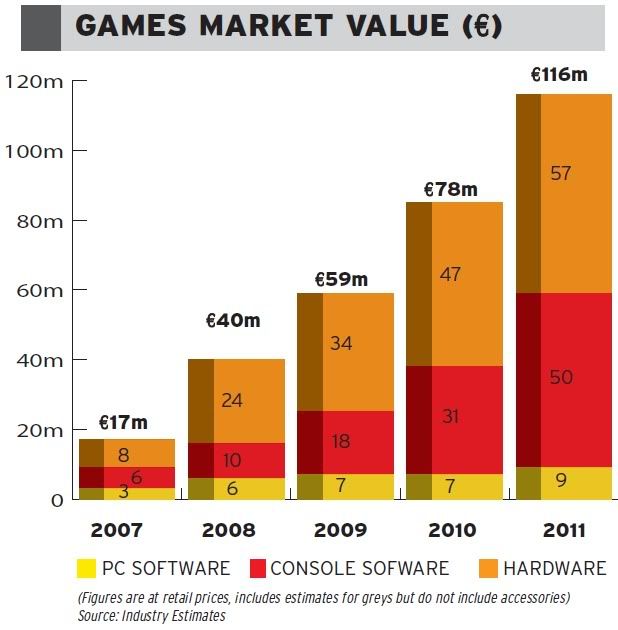

Nevertheless, what is clear now is that the games market is advancing with substantial growth in the last two years and further growth predicted. Although there is no official data, industry estimates value the market at a substantial €40m with it expected to double to €80m in the next two years. NASSCOM, India’s trade body for IT, had an even more upbeat prediction that the console gaming market would be €96m in 2010.

There are several factors that have helped the market growth, including the drastic rise in disposable income, the increasing mall culture, the organised presence of Sony, Microsoft and EA, release date parity with Europe, and platform holders heavily subsidising console pricing.

In a highly pirated market, software pricing is also key and locally replicated PS2 games can now sell for the magic price point of 499 INR (€8). Furthermore, Sony have invested in localised content of their own games (including SingStar Bollywood and Buzz Maha) and heavily encouraged local game development with the first result emerging in the form of PS2 title Hanuman.

There are still some market concerns including a largely negative economical mind-set, a lack of clarity on Nintendo's plans, high piracy and a current low rate of return for third party publishers – although revenues and profits are sure to increase as the market grows further.

Going forward, however, the future is very bright and the Indian games market will continue to be one of the fastest growing in the world pushed heavily by investments from the key players such as Sony.

These estimates include unofficial "grey imports".

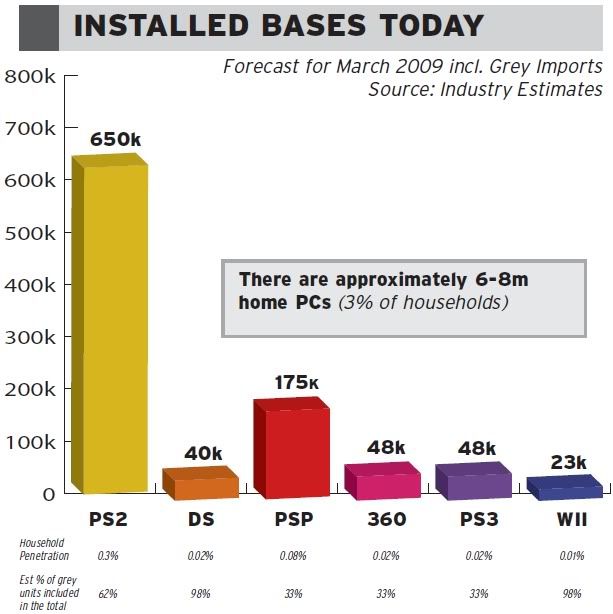

Here a percentage is given for the estimated number of unofficial "grey imports", note that Nintendo do not have an official presence in India. These figures are through March 2009:

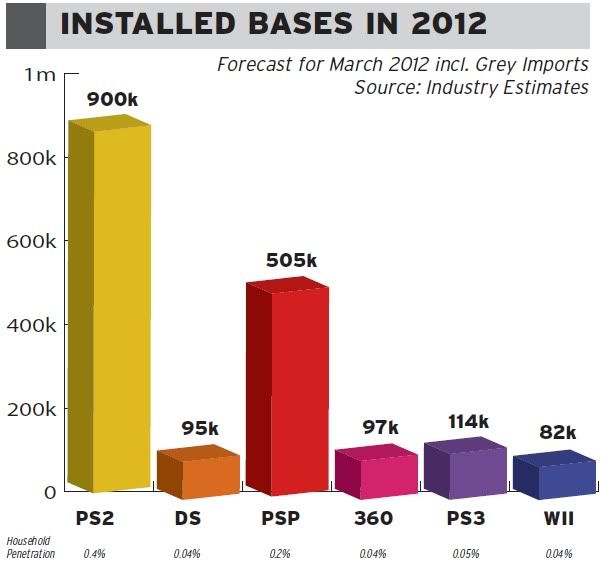

Total estimated official and unofficial units:

PS2: 650,000

PSP: 175,000

PS3: 48,000

360: 48,000

NDS: 40,000

WII: 23,000

Total estimated official units:

PS2: 247,000

PSP: 117,000

PS3: 32,000

360: 32,000

Total estimated unofficial units:

PS2: 403,000

PSP: 58,000

NDS: 40,000

WII: 23,000

PS3: 16,000

360: 16,000

No comments:

Post a Comment